Business Insurance in and around Kansas City

Looking for insurance for your business? Search no further than State Farm agent Dan Demory!

No funny business here

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes catastrophes like a customer stumbling and falling can happen on your business's property.

Looking for insurance for your business? Search no further than State Farm agent Dan Demory!

No funny business here

Cover Your Business Assets

With State Farm small business insurance, you can give yourself more protection! State Farm agent Dan Demory is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such considerate service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Dan Demory can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and call or email State Farm agent Dan Demory to investigate your small business insurance options!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

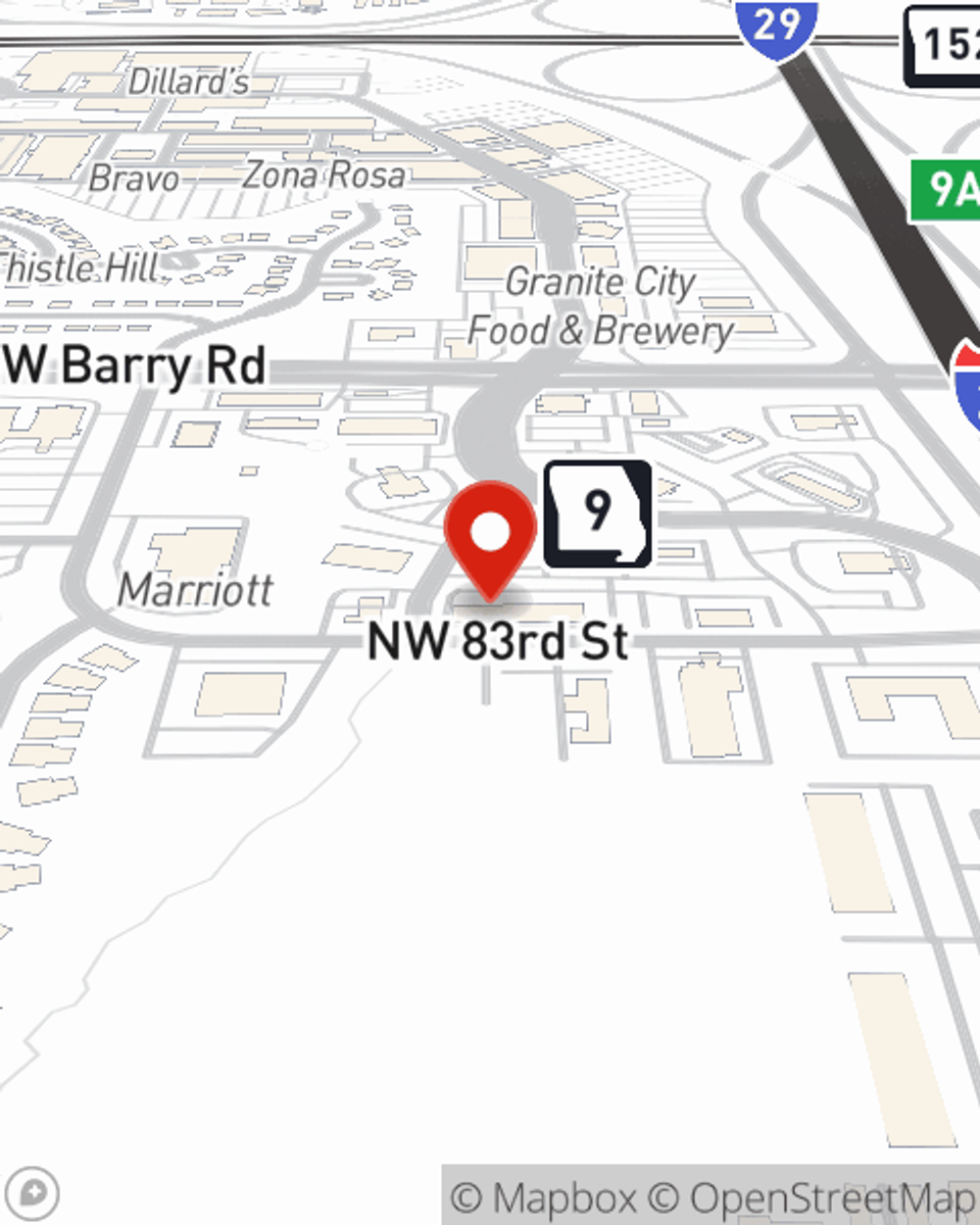

Dan Demory

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.